Empowering Future. Utilizing AI for

AI that puts in extra effort so your team can perform at their best. Use Pixl.AI Intelligent Document Processing (IDP) and ensure successful outcomes every time!

AI that puts in extra effort so your team can perform at their best. Use Pixl.AI Intelligent Document Processing (IDP) and ensure successful outcomes every time!

Pixl.AI specializes in using AI, Computer Vision, and Machine Learning to provide customized solutions. We specialize in compliance management and enhancing operational efficiencies through Artificial Intelligence. We assist financial sector firms in meeting RBI regulations and safeguarding customer privacy data with our innovative solutions.

Discover our innovative solutions designed to elevate your business.

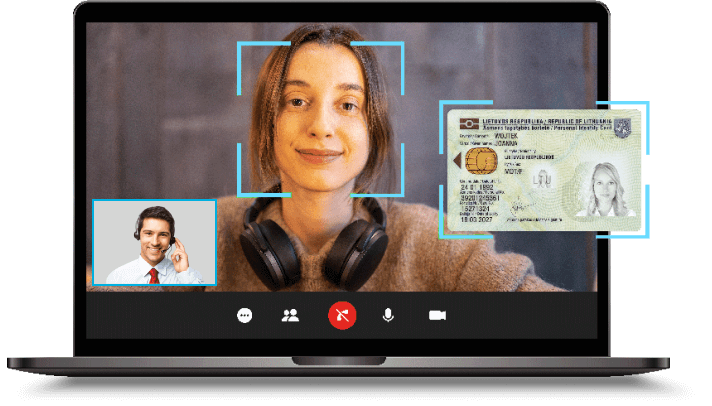

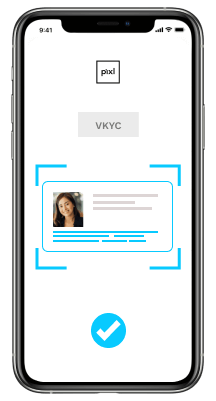

Pixl Video KYC is a secure and convenient method for verifying the identity of customers remotely, using video calls. We offer a streamlined process, enabling businesses to comply with regulatory requirements while enhancing customer experience by eliminating the need for physical presence.

Customers can undergo real-time verification with one to one agent support, ensuring a smooth and dependable experience from start to finish.

The customer is guided through the KYC verification procedure via a live video session.

Verifying the customer's background or history by accessing relevant records or databases during the KYC process.

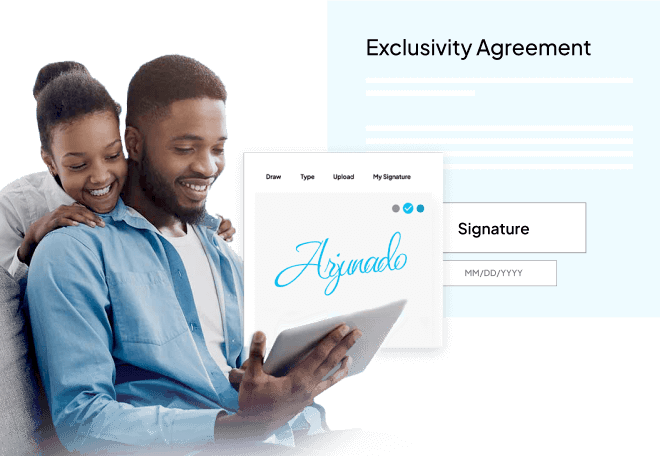

Extracting information from OVDs using OCR and recording the video interaction between the user and the KYC agent

Auditor conducts a thorough verification procedure to ensure compliance with regulatory standards and to verify the identity of the individual.

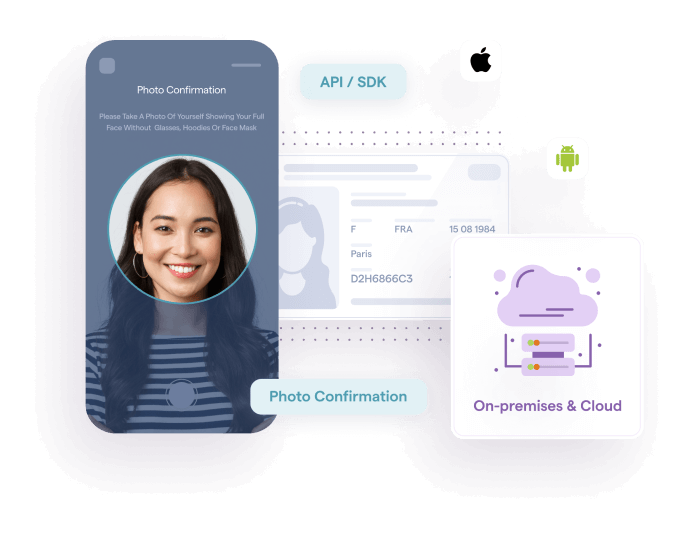

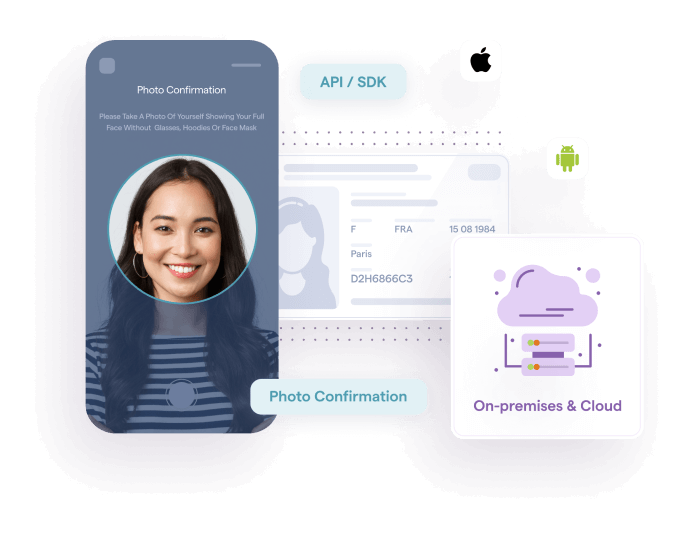

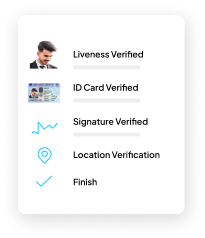

Non-assisted KYC (Know Your Customer) is a fully advanced AI driven automated way to verify a customer's identity without needing human intervention from the company's side

The customer initiates the KYC process through an online platform. This could involve logging into their account or accessing a dedicated KYC section.

Advanced liveness detection verifies customer presence, fortifying against fraud and markedly elevating security in the verification process.

Simplified OVD verification enables customers to upload document images in real-time, expediting processes and removing in-person requirements.

The KYC process is completed and the customer is successfully onboarded

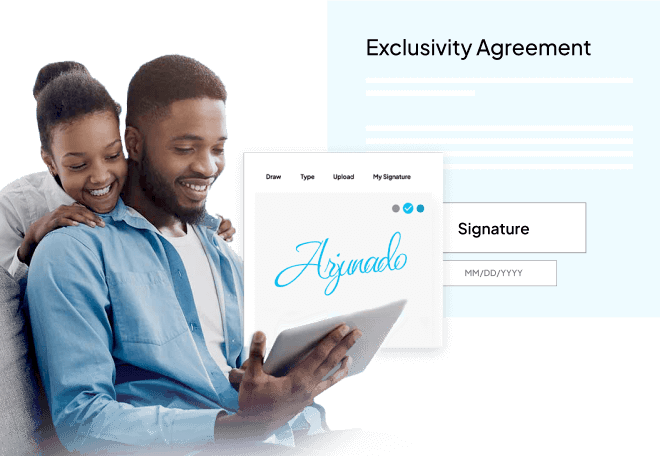

eSign software accelerates document signing and approval processes, rendering them faster, more convenient, and compliant. Beyond simplifying signing workflows, it presents numerous additional advantages for businesses. eSign solutions verify who is signing using codes (OTP) or secure keys.

Pixl's e-Bank Guarantee system smoothly connects with NeSL, the RBI's platform for electronic Bank Guarantees. This makes it easy for banks to send and receive e-BG requests.

Aadhaar eSign, integrated with NSDL, empowers you to digitally sign documents effortlessly, ensuring full legal compliance.

Simplify workflow and enable effortless e-signatures by connecting your ERP/CRM systems.

Our solution ensures your e-signatures are valid under international regulations.

E-signature solutions streamline the integration process with Banks's existing tools and platforms.

Pixl Intelligent document processing (IDP) frees up valuable time and resources by automating the capture, extraction, and processing of data from various document formats. It leverages AI technologies like NLP, Computer Vision, Deep Learning, and Machine Learning to accurately classify, categorize, extract, and validate relevant information, eliminating tedious manual data entry

The process starts by collecting documents from various sources, including scanned paper documents, PDFs, emails, faxes, and other digital files.

Images may be cleaned up to improve quality (removing noise, fixing skewing, etc.)

IDP extracts data from documents using OCR/ICR and NLP, finding details from documents. It checks accuracy with preset rules and uses ML to catch errors based on past patterns, improving data quality & efficiency.

The validated data is formatted into a structured output (like XML, JSON, or CSV) that can be easily integrated into other business systems for further processing.

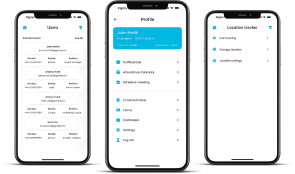

Say goodbye to outdated sign-in sheets and hello to a smooth visitor experience. Pixl Visitor Management Software makes guest registration, host notification , and data collection a breeze. Enhance your building's security, project a professional image, and create a welcoming environment from the moment visitors step through your door

Visitor scans a unique QR code to begin the process

System captures the visitor's photo for identification

The process of reviewing the historical records or past visits of a visitor

Visitor enters their name and relevant details

The host receives an alert about the visitor's arrival

Visitor checks out and provides optional feedback

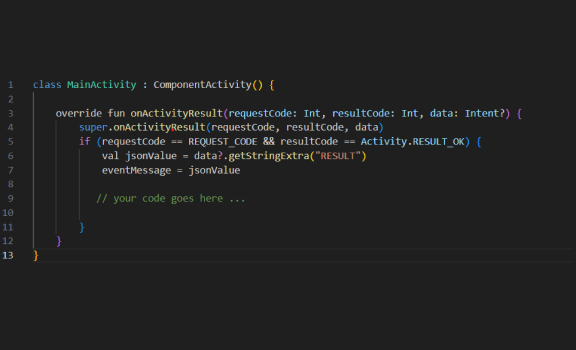

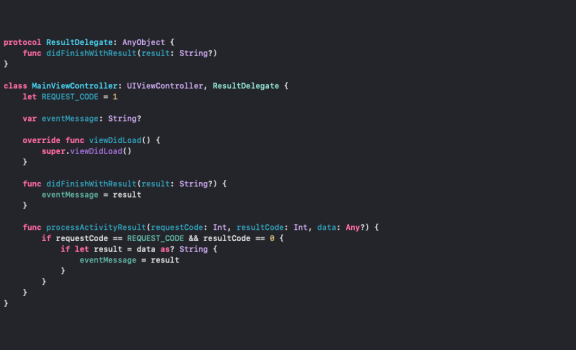

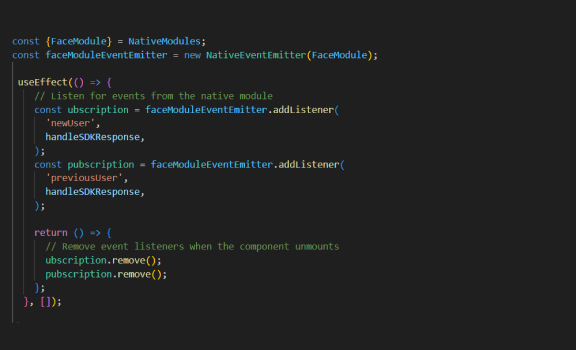

Our APIs and SDKs are designed for simple integration, allowing you to effortlessly connect them with your existing systems. Automate those time-consuming processes and unlock powerful workflows that revitalize your business.

Experience the benefits of increased efficiency, streamlined operations, and the competitive edge that comes from optimizing your core processes

Access to a team of industry-leading experts with extensive experience in deep learning, AI, and ML.

Dedicated customer support and ongoing assistance to ensure seamless integration and optimal performance of solutions.

Building long-term relationships with clients based on transparency, collaboration, and mutual success.

With Pixl's technology, banks can smoothly sign up new customers by verifying their identity, ensuring security, and protecting against fraud. Our solutions not only make the process easy for users but also boost efficiency and save money for banks while minimizing risks.

Know More

Boosting your team's productivity starts by carefully charting your sales efforts. We automate repetitive tasks, boost efficiency, and simplify operations, accelerating customer onboarding for swift growth.

Know More

Enhance claims processing efficiency for both clients and staff through automated document handling, damage evaluation, quality assurance in customer service, and beyond.

Know More

Pixl offers enhanced efficiency, security, and compliance. They enable real-time transaction monitoring, aiding in fraud detection and regulatory compliance. Streamlining KYC/AML processes, OCR solutions extract and verify identity information from documents.

Know More

In healthcare, patient data management is key, and Pixl is here to assist.Our software simplifies tasks like patient registration, consent forms, and billing by digitizing and automating processes for healthcare organizations.

Know More

We simplify document processing, aid in comprehensive legal research, and streamline contract analysis and management in the legal sector. By digitizing documents, analyzing data, and extracting key information, these technologies save time, enhance productivity, and improve decision-making.

Know More

Say goodbye to manual tasks in logistics paperwork. Let our automation handle invoices, packing lists, customs paperwork, and more, effortlessly streamlining your operations.

Know More

Pixls solution in maritime and aviation industries digitize documents, automate data extraction, and ensure regulatory compliance.This streamlines processes, reduces errors, and enhances efficiency, ultimately improving operations and safety.

Know More

In the gaming industry pixl’s solution can lead to more engaging gameplay experiences, informed game development decisions, enhanced security measures, and better community management, ultimately driving greater success and satisfaction for both gaming companies and players alike.

Know More

We can help you save significant time and resources by eliminating the need to piece together different onboarding components.

Get fast, accurate KYC, KYB, and AML compliance without the hassle, regardless of your jurisdiction or business needs.

Expand globally with confidence. Our solutions ensure seamless compliance across all regions and regulations, empowering borderless growth and secure verification.

Elevate customer protection and unlock growth with the power of generative AI for identity verification.

Our innovative solutions, driven by Generative AI and Large Language Model (LLM) capabilities, redefine the way different industries operate, from risk assessment and fraud detection to customer engagement and portfolio management.

Periodically verifying the identity and information of customers who are already onboarded by a business or financial institution.

Read MorePartially concealing or masking certain digits or characters of the Aadhaar number, which is a unique identification number issued to Indian residents

Read MorePartially concealing or masking certain digits or characters of the Aadhaar number, which is a unique identification number issued to Indian residents

Read MorePeriodically verifying the identity and information of customers who are already onboarded by a business or financial institution.

Read MorePeriodically verifying the identity and information of customers who are already onboarded by a business or financial institution.

Read Moreverify that a person is physically present and actively participating in a biometric authentication process, such as facial recognition or fingerprint scanning

Read More

Our Web & Mobile SDKs make connecting your applications to our powerful features a breeze. These easy-to-use toolkits handle the heavy lifting, streamlining the integration process and getting you up and running quickly.

OLorem Ipsum is simply dummy text of the printing

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy.

VP of Product

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy.

VP of Product

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy.

VP of Product