Bank

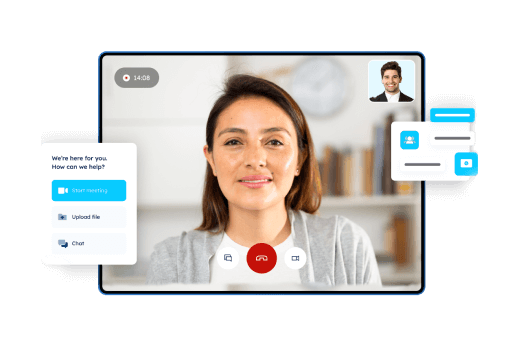

Traditional banking onboarding can take

weeks and incur substantial costs for KYC checks and compliance. Our digital

customer verification solution, utilizing VCIP, offers a compliant, cost-effective, and

fraud-resistant platform. It

seamlessly guides banking customers through the verification process.

Key Benefits

Reduce onboarding time by 90%

Cut operational costs by 60%

Enhance fraud detection by 75%

Contact

Us

NBFC

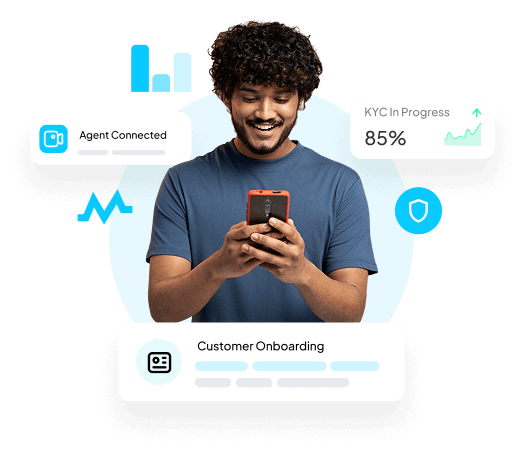

RBI-regulated NBFCs have the option to

accelerate customer

identification through Video KYC. Our secure Video KYC solution enhances verification speed,

providing a more

convenient experience. Customers can effortlessly open accounts

or secure loans using just a phone and an internet connection.

Key Benefits

Reduce onboarding time by 90%

Cut operational costs by 60%

Enhance fraud detection by 75%

Contact

Us

NBFC

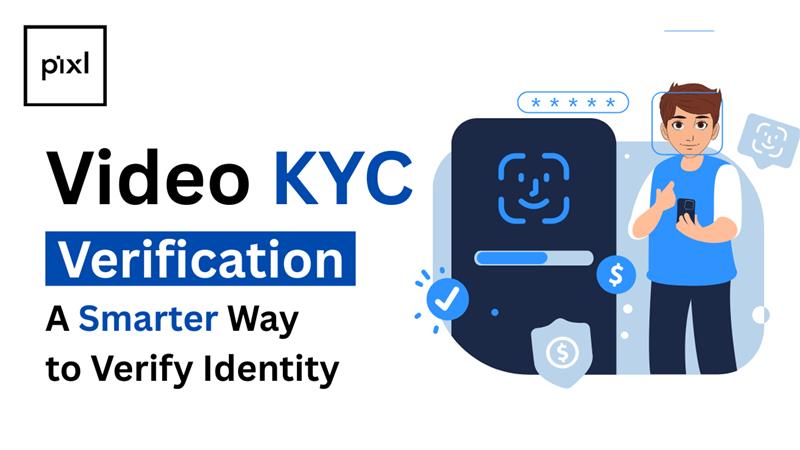

Utilize our adaptable Video KYC Platform

and onboarding solution, incorporating VCIP to create a positive impression on

new hires, setting the stage for a long and promising relationship with your company. Simply

onboard employees globally

through our video KYC Platform, ensuring a streamlined and efficient onboarding process.

Key Benefits

Reduce onboarding time by 90%

Cut operational costs by 60%

Enhance fraud detection by 75%

Contact

Us

Crypto

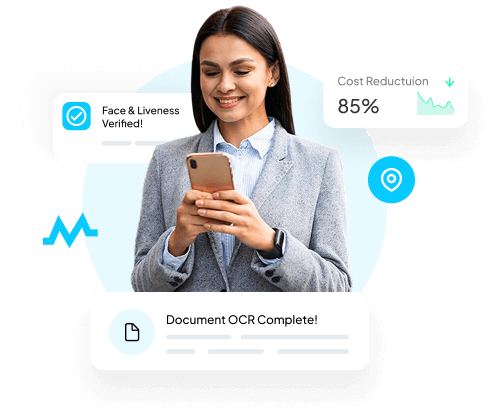

Pixl accelerates and streamlines the crypto

KYC verification process with advanced real-time AI-driven document

verification, OCR-enabled picture data extraction, facial matching, and machine

learning-based fraud filters. These

technologies not only expedite the process but also elevate AML compliance standards,

effectively reducing fraud within

the industry.

Key Benefits

Reduce onboarding time by 90%

Cut operational costs by 60%

Enhance fraud detection by 75%

Contact

Us