Effortless Re-Verification & Engagement with

Re-KYC Solution

Go Paperless with Re-Know Your Customer Process & Keep Customer Information Current

Go Paperless with Re-Know Your Customer Process & Keep Customer Information Current

Financial institutions and brokerage firms face ongoing risks of illegal activities and misuse, posing potential threats to customers. To ensure compliance and mitigate risks, banks and financial entities maintain updated customer documentation obtained during the account opening process.

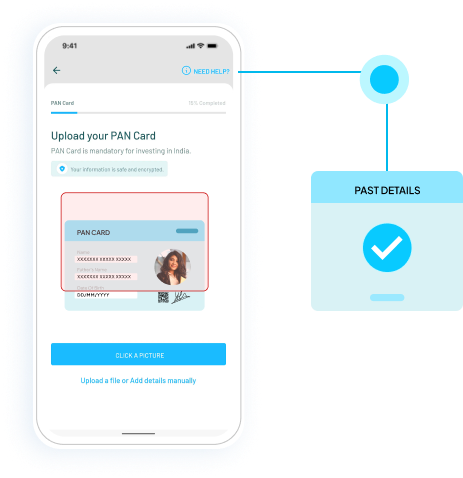

Reach out to past customers who have gone quiet and remind them of the value you offer.

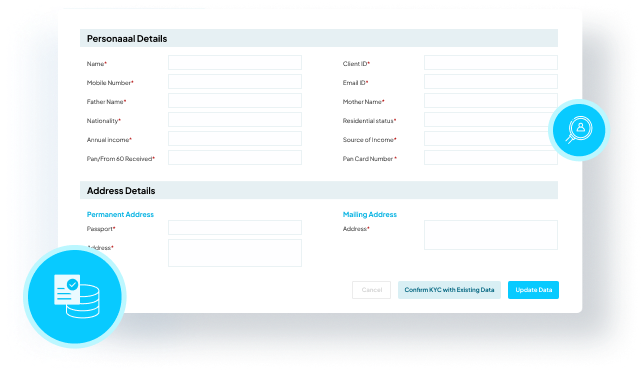

Allows customers to modify or update their personal and financial information that was previously submitted during the initial KYC process.

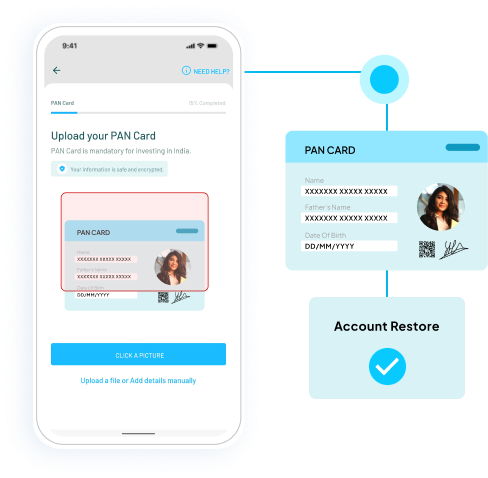

We've made it easier than ever to reactivate a client's account with our simple and efficient process.

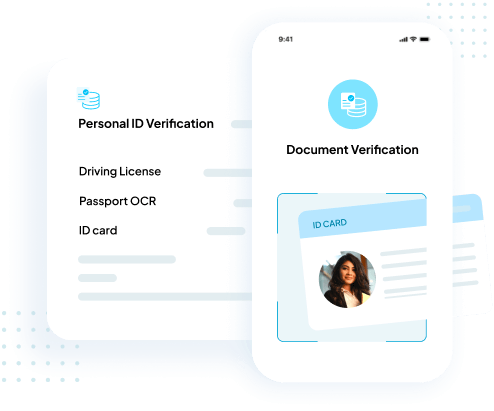

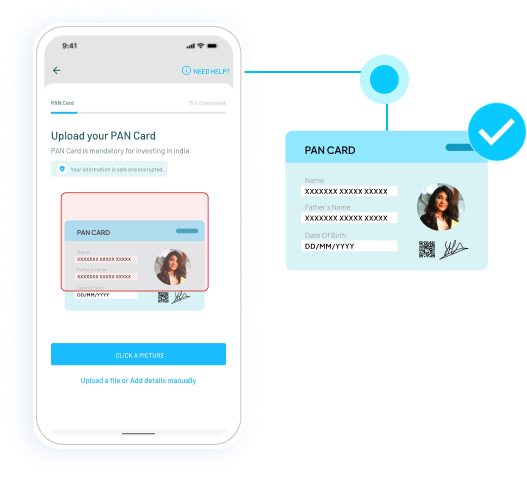

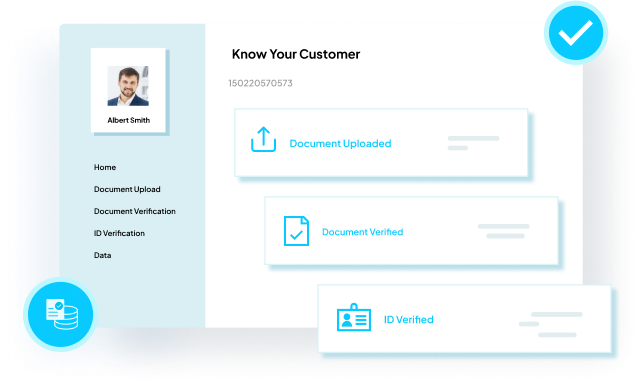

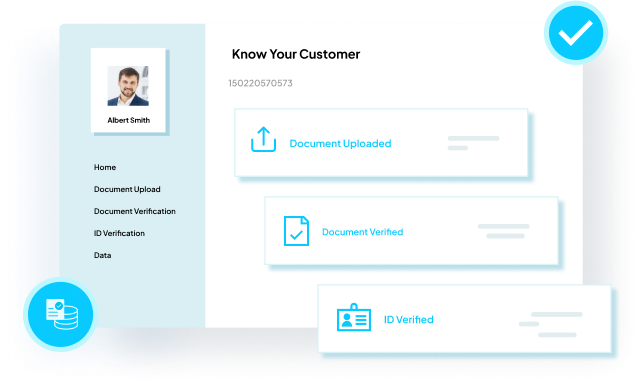

Re-KYC is a simple process designed to keep your information current. It involves updating your personal or financial details and submitting any required documentation, such as proof of identity or address.

Clients can easily update their information and documents.

We verify all new data and documents for accuracy and compliance.

Approved changes are quickly updated.

ensures due diligence and ongoing regulatory compliance.

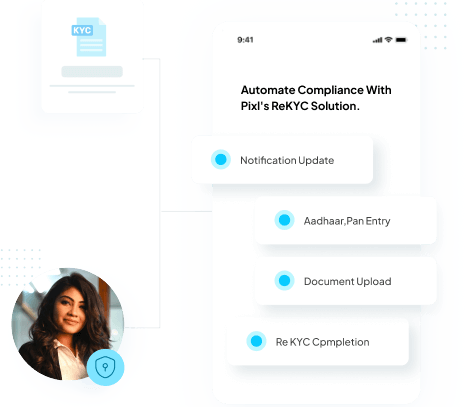

Automated systems update customer info without manual work, saving time and avoiding errors. This keeps data accurate without human input, boosting efficiency and letting staff focus on important tasks, making customers happier.

Automated systems update customer info without manual work, saving time and avoiding errors. This keeps data accurate without human input, boosting efficiency and letting staff focus on important tasks, making customers happier.

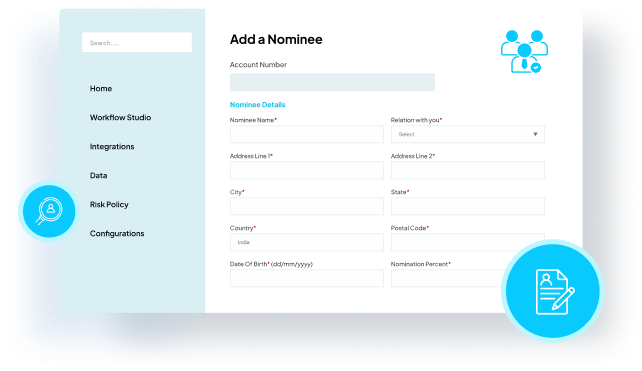

Make it easy for customers to pick who will manage their accounts next if necessary. This ensures a smooth switch of ownership, which is vital for stability during unexpected events. It gives both customers and businesses peace of mind, knowing they're prepared for whatever comes their way.

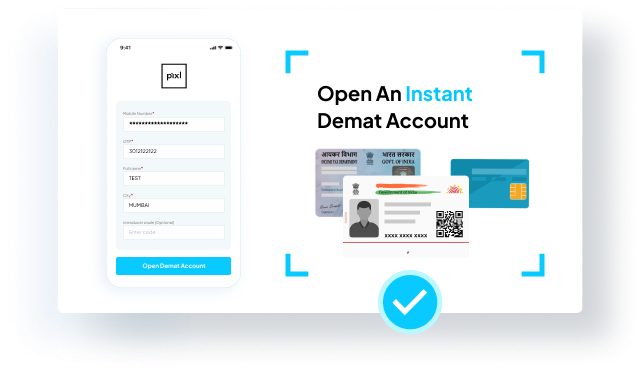

Make it easy for customers to update their Demat accounts by offering user-friendly online platforms or mobile apps. They should access their accounts effortlessly and edit personal details, contact info, or nominee details. Providing clear instructions simplifies the process further.

Ensure that customer information remains accurate and precise to improve decision-making processes and comply with regulations. This means consistently verifying and updating customer data to avoid errors and inconsistencies.