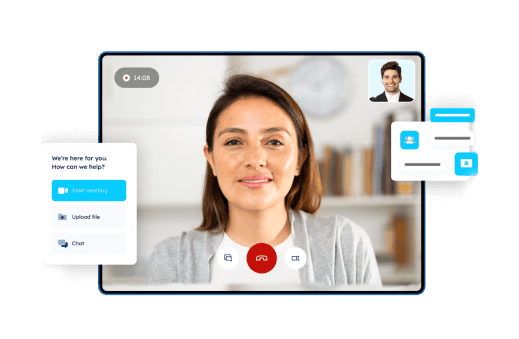

The way banks verify your identity is undergoing a revolution. Enter VCIP, the Video-Based Customer Identification Process. Imagine a secure video call where a bank representative guides you through the process, ensuring everything is transparent and above board. This innovative RBI-approved approach eliminates the need for physical documents and branch visits, streamlining customer onboarding like never before.

Informed Consent: You’re in Control

The process starts with your explicit permission for a video interaction. This ensures transparency and compliance, putting you in control from the very beginning.

Secure Video Call: Verification Made Easy

During the call, a live video recording and photograph are captured for verification. Cutting-edge security measures safeguard the entire interaction.

Faster Onboarding, Reduced Costs

No more waiting in lines! VCIP can be completed in minutes, significantly speeding up account creation and reducing administrative expenses for banks.

Beyond Traditional KYC

VCIP offers a clear advantage over traditional methods that rely on physical documents and in-person verification. Gone are the days of lengthy appointments and paperwork.

The Power of VCIP in Four Key Areas

- Digital Onboarding: VCIP facilitates entirely online account opening, aligning with the digital transformation in banking.

- Efficiency: The process is designed for speed, completing KYC within minutes.

- Regulatory Compliance: VCIP adheres to RBI guidelines, ensuring secure customer identification.

- Cost-Effectiveness: By digitizing identification, VCIP reduces costs associated with traditional methods.

Key Aspects of VCIP: Streamlining Customer Onboarding

VCIP (Video-Based Customer Identification Process) revolutionizes customer onboarding by leveraging technology for secure and efficient remote verification. Here’s a breakdown of its key aspects:

Informed Consent: You’re in Control (replaces Empowering Customers with Control)

VCIP prioritizes transparency and user privacy. The process starts with your explicit consent for a video call, ensuring you’re comfortable and informed throughout. You’ll know exactly what information is being collected and how it’s used.

Secure Data Capture for Verification

During the video interaction, a live recording of you and a photograph are captured for verification purposes. These recordings are encrypted and stored securely using cutting-edge security measures.

Aadhaar Verification (India) (replaces Leveraging Existing Government IDs)

In some regions, VCIP integrates with government-issued identification programs. The official can use your Aadhaar card (India) during the video call to electronically verify the information you provide, ensuring accuracy and streamlining the process.

Digital KYC: A Modern Approach

VCIP falls under digital KYC (Know Your Customer). It replaces traditional methods that rely on physical documents and in-person verification with a secure and efficient electronic approach. This expedites onboarding and reduces the risk of lost or tampered documents.

A Streamlined Process in Action

- Initiation with Consent: The authorized official initiates a video call, obtaining your permission beforehand.

- Data Capture: During the video interaction, the official captures live video and a photograph.

- Aadhaar Verification (India): Your Aadhaar card is used for verification, ensuring information accuracy.

- Secure Live Interaction: The entire interaction is conducted securely, emphasizing its live nature and dependence on your informed consent.

- Paperless and Contactless: VCIP eliminates paperwork and physical contact, aligning with modern trends for seamless experiences.

- RBI Approval: The VCIP procedure is approved by the Reserve Bank of India, solidifying its security.

VCIP vs Traditional KYC: A Paradigm Shift

Traditional KYC relies on physical documents and in-person visits, leading to delays. VCIP leverages technology for remote verification through video calls, streamlining the process for faster onboarding.

As a core component of modern digital onboarding, the Video KYC solution plays a central role in enabling VCIP by facilitating real-time, secure customer verification.

The VCIP Implementation Process

VCIP KYC involves assessing customer risk profiles, conducting sanctions screening, monitoring account activity, and updating KYC information.

RBI Regulations: Ensuring Security

The RBI has established regulations for data privacy and customer protection during VCIP. These ensure secure data collection, storage, and access.

Benefits for Businesses: A Winning Combination

- Efficient verification reduces fraud risks and protects businesses financially.

- Regulatory compliance ensures adherence to AML/CFT regulations.

- Cost and time savings eliminate the need for manual verification and later investigations.

- Consistent experience provides a uniform verification process for all customers.

- Enhanced trust fosters customer loyalty by demonstrating a commitment to security.

Conclusion: A Brighter Future for Onboarding

VCIP KYC offers a secure and efficient solution for customer onboarding. Businesses benefit from streamlined verification, reduced costs, and compliance. For customers, VCIP provides a convenient and secure alternative. As identity verification simplifies, VCIP paves the way for a smoother and safer digital experience for everyone.