Pixl C-KYC

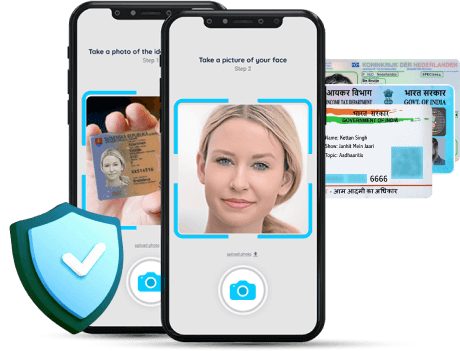

plug & play C-KYC integration.

Dive into seamless automated upload/download, API-powered search and download, and a built-in data management system. Our solution transcends mere document handling, streamlining your entire CKYC process with effortless integration options.

Instantly integrate with your existing systems.

Connect your core data system to CERSAI CKYCR for intelligent search & download.

API/Cloud/Web services integration with multiple back offices for smooth operations

Automated scheduling using Straight Through Processing (STP).

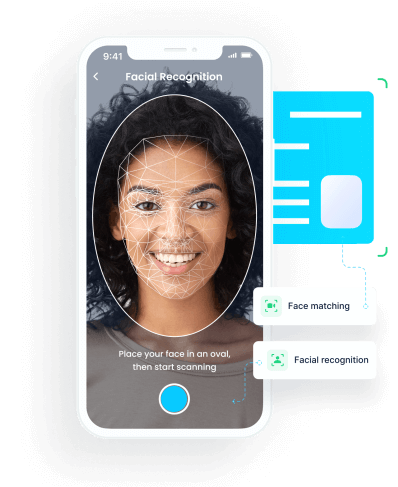

Fully automated functionality with customer de-duping to prevent duplicates.

Create a pipe-separated text file according to CERSAI’s guidelines.

Upload the prepared batch file to the C-KYC portal via SFTP.

The checker admin reviews and approves the uploaded data.

Manually check for approval or error messages from CERSAI regarding the uploaded files.

Correct any errors in the batch files and re-upload them to the C-KYC registry.

The Central Know Your Customer (CKYC) initiative by the Government of India aims to centralize KYC records of customers in the financial sector. The Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) manages this registry, digitizing customer KYC documents to eliminate repeated verifications.

Contact Sales

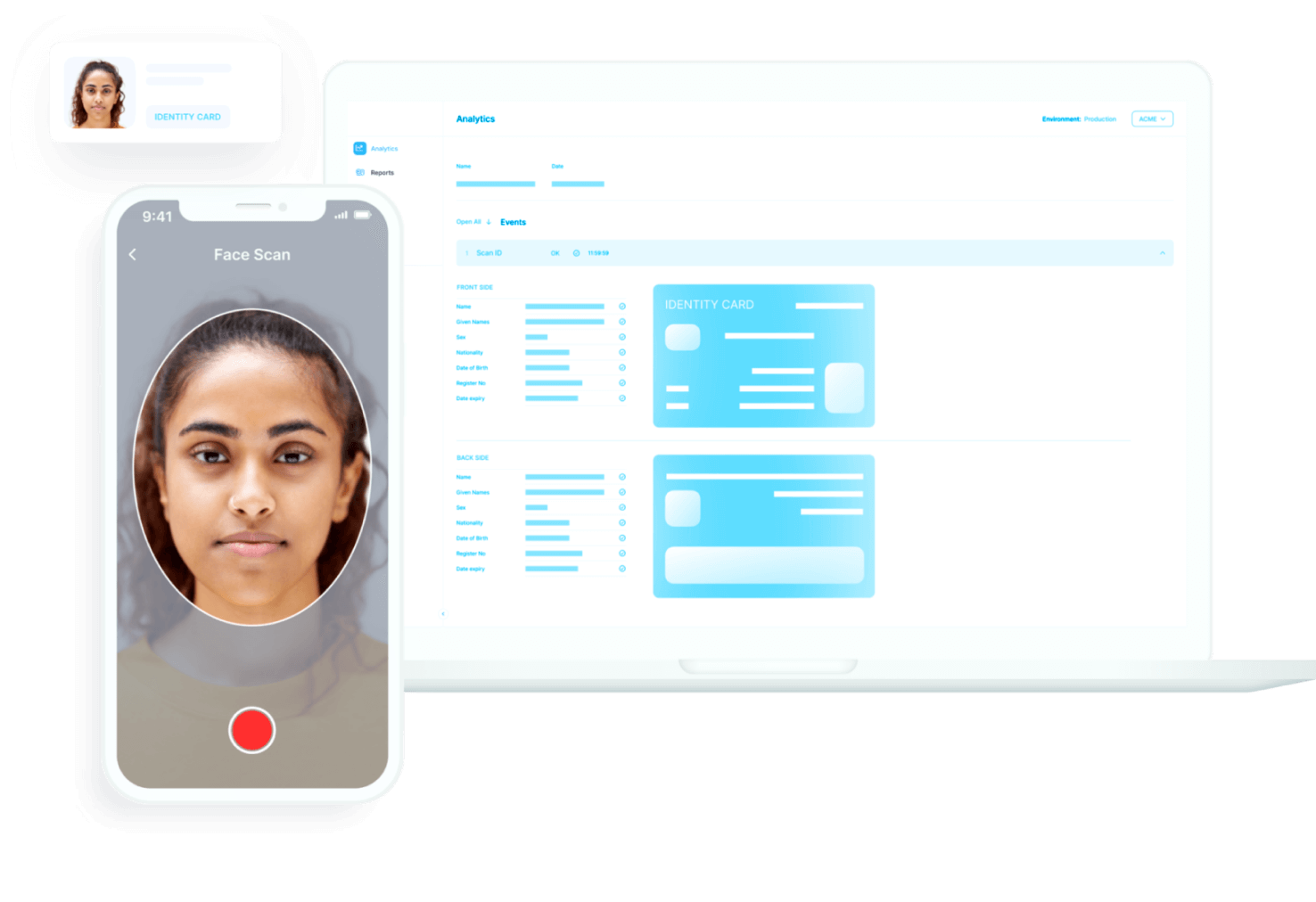

Monitor accounts and KYC data status daily for up-to-date information.

Region-wise and branch-wise analytics for comprehensive insights into your operations.

Monitor accounts and KYC data status daily for up-to-date information.

Full Automation: End-to-end CKYC automation with no manual intervention, boosting efficiency.

Customizable from start to finish to meet your specific requirements.

Complete Visibility 100% process visibility with detailed dashboards for transparent operations.

Take the leap towards unparalleled efficiency