Invoice OCR technology has become essential for businesses that want to automate data extraction, reduce human error, and accelerate accounts payable operations. Mindee is a well-known OCR solution, but it may not fit every organization’s requirements, especially those needing higher accuracy, deeper automation, and enterprise-grade scalability.

If you are looking for strong alternatives to Mindee, here are the top 5 platforms that most complete, scalable, and intelligent invoice OCR solutions in the market.

1. Pixl.ai – The Most Accurate and Automation-Ready Invoice OCR API

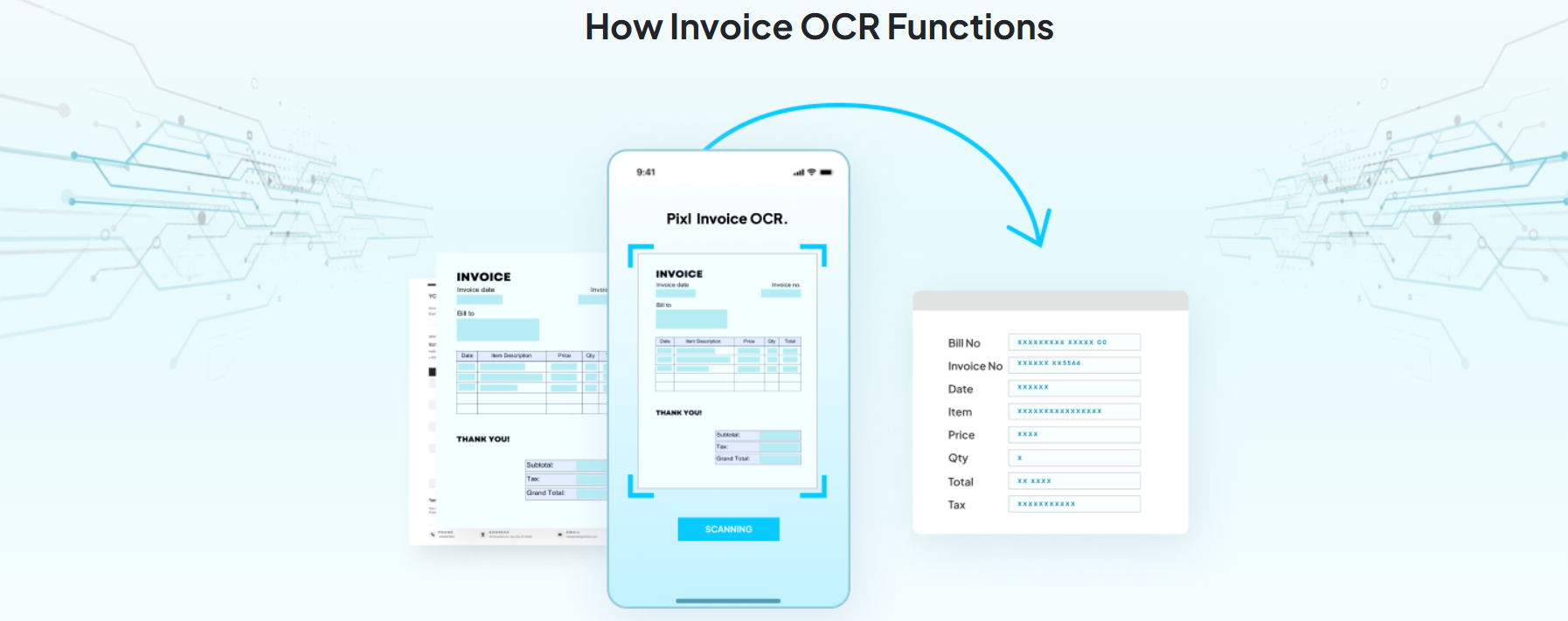

Pixl.ai Invoice ocr offers one of the industry’s most intelligent, accurate, and API-driven invoice OCR solutions. Built specifically for financial operations, it provides end-to-end automation to streamline invoice processing for businesses of all sizes.

Why Pixl.ai Stands Out

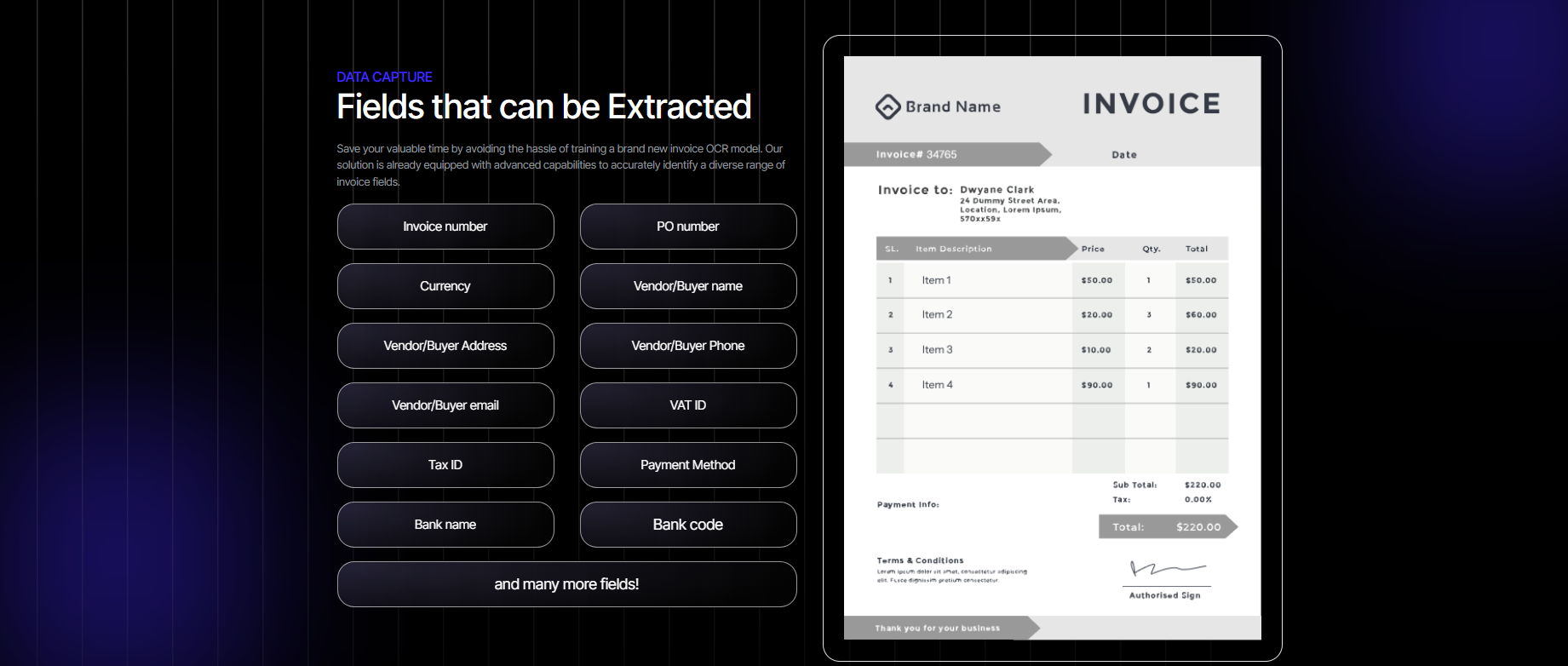

Pixl.ai ensures instant invoice data extraction powered by cutting-edge AI. No manual data entry, no errors, no delays. From vendor data to line items, taxes, and totals everything is captured and validated automatically.

Pros

- Industry-leading OCR accuracy for invoices, receipts, and financial documents

- Automated extraction of line items, GSTIN, vendor details, tax breakdowns, totals

- API-first design compatible with ERPs, accounting platforms, and financial systems

- Real-time error checking and field validation

- Extremely fast processing for bulk invoice uploads

- Easy-to-use dashboard with real-time monitoring

- Highly scalable — ideal for SME to enterprise-level invoice volumes

- Excellent fraud prevention and anomaly checks

Cons

- Focuses purely on OCR and financial automation; requires integration for full AP workflows

Pixl.ai is ideal for businesses that need a fast, accurate, and enterprise-ready invoice OCR solution that scales effortlessly.

2. PixDynamics

PixDynamics brings a strong combination of OCR, compliance, and document automation. It is built for industries that require security, traceability, and controlled workflows such as BFSI, NBFCs, insurance, telecom, and enterprises.

Why PixDynamics Stands Out

PixDynamics emphasizes data security and compliance, offering a powerful platform that ensures every document is extracted, encrypted, validated, and tracked with audit-level transparency.

Pros

- Highly secure document handling with strong encryption

- Compliance-ready platform with audit trails and regulatory alignment

- Automated extraction of key invoice fields including line items

- Customizable workflows with maker-checker support

- Secure dashboard for monitoring document processing

- On-premise, cloud, and hybrid deployment options

- Ideal for high-volume enterprise use

Cons

- Requires some configuration effort for custom workflows

3. Nanonets

Nanonets is a popular option for small and mid-size teams that want quick deployment with minimal technical work. It offers a no-code environment and simple workflow setup.

Pros

- Easy-to-use, drag-and-drop model builder

- Pre-trained invoice OCR templates

- Zapier and API integrations

- Auto-learning models

- Fast onboarding with minimal setup

Cons

- Limited accuracy for complex or unstructured invoices

- Not ideal for large-scale enterprise workloads

- Requires retraining for better accuracy in many cases

A good choice for small businesses, but not powerful enough for enterprise-grade invoice processing.

4. Stripe

Stripe’s invoice OCR is designed primarily for businesses using the Stripe ecosystem for payments and billing. It focuses on capturing essential invoice data and syncing it with Stripe’s financial tools.

Pros

- Auto-capture of invoice totals, taxes, and customer details

- Native integration with Stripe Billing and Payments

- Real-time reconciliation and analytics

- Very easy to set up for existing Stripe users

Cons

- Works best only within the Stripe ecosystem

- Limited field extraction and no advanced line-item intelligence

- Not designed for full AP automation

Stripe Invoice OCR is helpful for billing-focused operations, but not suitable for complete invoice automation.

5. Volopay

Volopay combines expense management, corporate cards, and invoice OCR into one platform. Its OCR feature is useful for basic invoice automation as part of a broader financial suite.

Pros

- Invoice OCR for vendor details, taxes, and totals

- End-to-end AP workflow with approvals and payments

- Multi-currency support

- Integrations with accounting tools like Tally, QuickBooks, and Xero

- Centralized spend management + invoice processing

Cons

- OCR capability is secondary and not as accurate as specialized tools

- Not designed for complex invoice formats

- Limited scalability for very large invoice volumes

Volopay works well for organizations needing general spend management, but not specialized invoice extraction.

Why Pixl.ai is the Best Alternatives to Mindee Invoice OCR

Most invoice OCR providers focus on either accuracy. pixl.ai combine both worlds to deliver a more robust, scalable, and intelligent solution.

Here’s what makes them unbeatable:

- End-to-end AI-driven invoice processing

- Best-in-class extraction accuracy

- Deep workflow automation and ERP integrations

- Browser-based and API-first accessibility

- Secure, compliant architecture suitable for regulated industries

- Zero manual work — everything from extraction to validation is automated

- Faster onboarding and faster go-live

- Ideal for SMEs, enterprises, and high-volume financial operations

With these capabilities, businesses can run their AP operations more efficiently, more accurately, and with less operational overhead.

Conclusion

Invoice OCR is a game-changer for modern finance teams. While Mindee is a recognized player, solution like Pixl.ai go far beyond by offering superior accuracy, deeper automation, better user experience, and enterprise-grade scalability.

Whether you operate in banking, fintech, NBFCs, retail, logistics, or enterprise finance, choosing a powerful invoice OCR platform can significantly transform your AP operations and future-proof your business.