KYC stands for Know Your Customer. Documents that are required for businesses to know your customer is KYC documents.

service that we are offer

KYC stands for Know Your Customer. Documents that are required for businesses to know your customer is KYC documents. These documents are normally divided into two distinct categories:

- Proof of Identity (POI) document – requires a photo of the individual

- Proof of Address (POA) document – cannot be dated older than 3 months

Why is this relevant within the identity verification industry? When a business digitally onboards new customers, they are required to ensure they can accurately prove the identity of their customer using KYC checks.

It is important to note that the same document cannot be used to confirm both the user’s identity and the place of residence. At least two documents are required for the KYC process. The acceptable KYC documents vary depending on which jurisdiction the process is being performed in.

The first half of a KYC document must be an official government-issued ID. This document must include a photo of them. There are a variety of IDs that are allowed to be used for POI purposes. Which are acceptable and where is determined on a jurisdictional basis.

Some commonly accepted POI examples from around the world are:

- Passports

- National Identification Cards

- Driving License

- Voter ID card

- Health Card

Every company that performs proof of identity (POI) checks should have a comprehensive KYC guide that describes the process and requirements for the user. Pixl document text reader solution that performs proof of identity (POI) checks should have a comprehensive KYC guide that describes the process and requirements for the user.

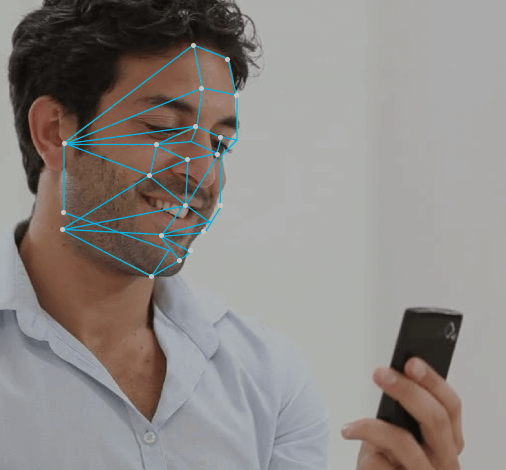

We use the smartphone (or any other) camera to scan and extract information from the identity document to determine the authenticity of the document automatically. Users just need to point their camera at the document, our solution then detects which document it is and extracts information from the document.

Most documents have machine-readable code line(s) (MRZ) on the backside of the document. We extract the information and run various checks on the MRZ itself. We then extract further information from the rest of the document known as the visual inspection zone (VIZ). However, purely extracting information from the document is not enough, we also want to ensure that we are dealing with a real document and not a fake. To assess the authenticity of a document, we analyze hundreds of different visual key features and run a variety of security checks, such as detecting holograms, on the document.

More and more identity documents now come with a biometric NFC chip. Using the smartphone NFC reading capabilities (if available), we are also able to read the information from the document and check whether the chip in the document has been tampered with. This today provides the highest security in document verification. In case the fully automated checks fail then, based on the security requirements of our customers or the regulations in place, there are steps in place to manually verify the documents proving identity. We provide an easy-to-use tool for guiding customers’ back-office employees through a simple manual verification.

The submission of KYC documents and the process of checking them is partial to an anti-money-laundering (AML) framework, which banks and financial institutions are legally obliged to follow. The goal of AML is to verify with a high degree of assurance that customers are who they say they are and that they are not likely to be engaged in criminal activity.