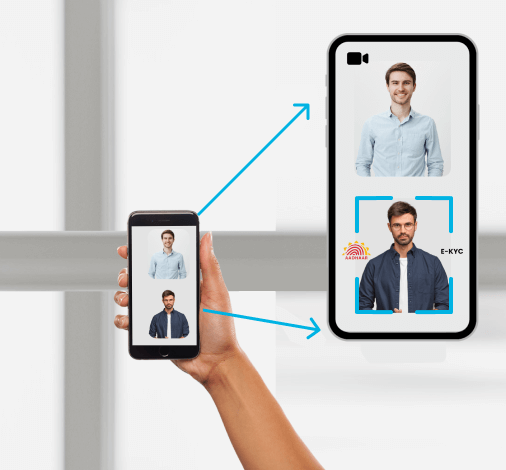

IRDAI allows insurance companies to use Video KYC. PiXL Video KYC makes the process simpler for the customers as it combines multiple processes of digital checks.

service that we are offer

IRDAI allows insurance companies to use Video KYC. The move comes at a time when regulators across the board are easing compliance processes during the ongoing coronavirus pandemic to minimize physical contact in line with the new hygiene and social protocols. With the world going remote there has been a forced digital shift in consumer behavior and the Insurance sector in India has also responded with the Insurance Regulatory and Development of India(IRDAI) relaxing KYC regulations. Considering the present situation, Video KYC RBI guidelines have allowed the Video KYC completion at an opportune time by the regulatory bodies to make the onboarding process digital, when meeting customers is almost impossible. Insurance companies are looking for solutions to enhance customer convenience and improve business efficiency in these times of economic turbulency, and PiXL.ai is here to help.

PiXL Video KYC makes the process simpler for the customers as it combines multiple processes of digital checks. It will also prevent identity theft issues as customers will not have to submit physical copies of their KYC documents. This step will greatly help in reducing the KYC costs for a small value loan and also provide a seamless onboarding experience for borrowers. Every financial bank goes through the tedious task of credit verification or personal verification. Now, PiXL Video KYC makes the verification process easier. PiXLS can get you game-ready. PiXL'S Video KYC capabilities can empower clients to create a seamless onboarding for their customers, ensuring RBI compliant guidelines.

Every financial bank goes through the tedious task of credit verification or personal verification. Now, PiXL Video KYC makes the verification process easier. With the increase in AI capability like ours, everything becomes digital and highly flexible. It is both user-friendly and handy for employees. It can be used for the process of savings account, loan application, loan underwriting, demand account, Life Insurance, and mutual funds. PiXL'S Video KYC Solution will reduce the customer onboarding process from the current 5-7 days to less than 3 minutes with its Video KYC model, making it easy for FinTechs to onboard customers from remote locations immediately.